- Details

- Written by Gordon Prentice

The law governing campaign finance is crystal clear.

It bans corporations and trade unions from making donations to candidates running in a municipal election.

But there is a glaring loophole that is crying out to be closed.

The law - and its clear intent - can be very easily circumvented.

Corporate titans in the development industry can simply donate as individuals, not on behalf of their businesses.

In the 2018 election, Vegh took $4,800 from four employees of the ubiquitous Groundswell Urban Planners whose signs dot Newmarket wherever a new development is being proposed.

$4,800 is not far short of my target spend of $5,000 for the entire campaign.

Groundswell as a business cannot donate.

What is the solution?

The Financial Statements, which must by law detail all donations, are submitted by candidates to the Town after the election.

The straightforward solution is to require candidates to publish a provisional list of donors, say, 10 days or one week before Election Day.

This would allow the press and media - and other candidates - to check whether any donor has a background in the development industry.

It's not perfect but it's better than what we have now. (And there is an obvious problem with advance polls. But we take this one step at a time.)

Chamber of Commerce "Meet and Greet"

I am hoping for a one-on-one debate with Tom Vegh but in its absence we have the Newmarket Chamber of Commerce "meet and greet" from 6pm-8pm on 27 September at the Community Centre at 200 Doug Duncan Drive. (Halls 1 and 2)

It is a drop-in format.

The Chamber has warned candidates there must be no speeches and no debate (it is an election after all) but we are allowed to display our literature on the tables we are allocated.

Vegh's 2018 Financial Statement

I intend to pile mine high with copies of Tom Vegh's Financial Statement for the 2018 election with all the developer names highlighted in unmissable day-glow yellow.

I shall invite curious members of the public to take one and, if they wish, wander over to Vegh's table, with his Financial Statement in hand, to ask the great man whatever is on their mind.

For me, I still want to know if developers are bankrolling his election this year.

But he won't tell me.

Maybe the voters will have more luck prising the answer out of him.

This email address is being protected from spambots. You need JavaScript enabled to view it.

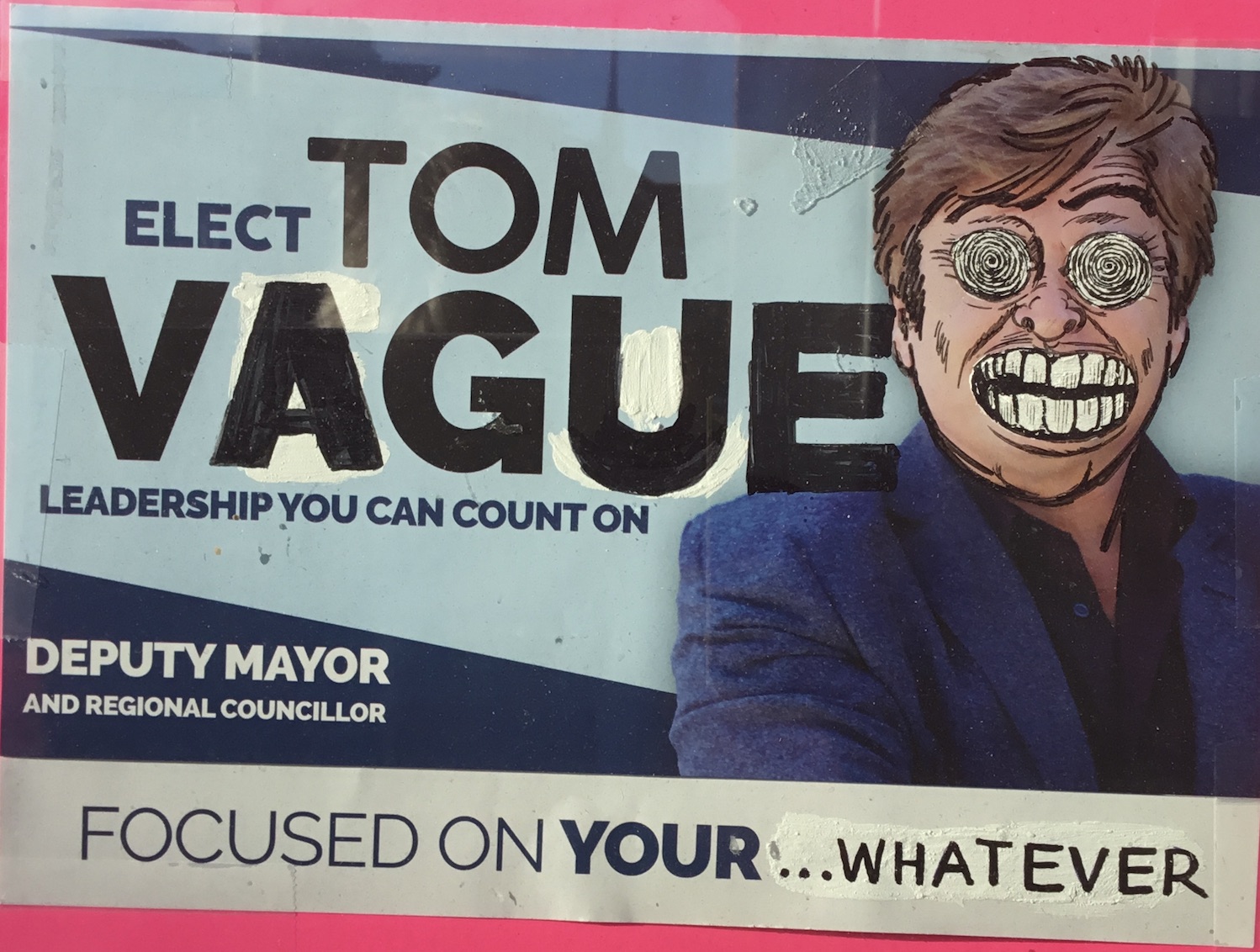

Note: Cartoon drawn for the 2018 election campaign by Steven Gilbert of Main Street's Fourth Dimension Comic Store.

- Details

- Written by Gordon Prentice

Developers bailed Tom Vegh out after the 2018 election when they were told he needed help in clearing a massive $30,000 deficit run up during the election campaign.

The cheques from developers came cascading in like a tsunami, rescuing Vegh from probable disqualification as a newly elected regional councillor.

Vegh could not use his own money to pay off the huge deficit as there is a hard cap on the amount of money candidates and their spouses can contribute to their own campaign. In 2018, the hard cap in the regional councillor race was $16,103.10. This year the self-funding limit is marginally lower at $16,098.

If the developers had not coughed up he would have been unable to pay off the enormous $30,000 deficit himself because of the so-called self-financing rules.

Buying elections

The self-funding cap is designed to prevent wealthy people buying elections using their own money. It is based on a straightforward formula taking into account the number of electors. It varies for the Mayor and regional councillor and for the individual ward candidates where it is, of course, much lower.

The 2018 Ontario Candidates’ Guide to the municipal election 2018 warns the penalty for exceeding the spending limit is disqualification.

“ if your financial statement shows that you exceeded your spending limit…. The penalty is that you forfeit your office (if you won the election) and you become ineligible to run or be appointed to fill a vacancy until after the 2022 election.”

Cash from developers

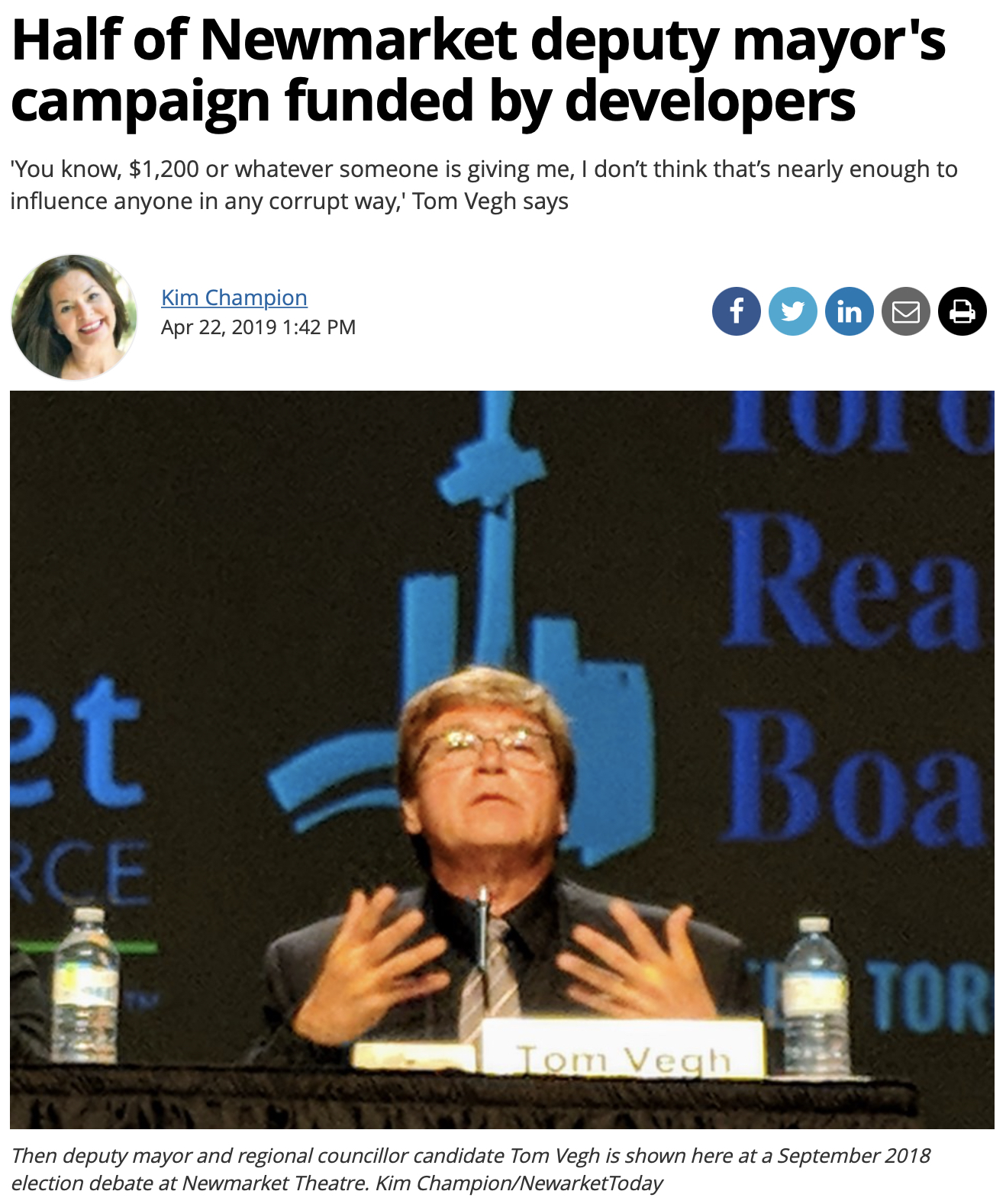

So the cash from the developers was absolutely crucial to Vegh's success. He admits as much in this extraordinary and revealing confession to Newmarket Today in April 2019.

Vegh’s personal spending on his 2018 campaign was capped at $16,103.60.

In another fascinating story in Newmarket Today Vegh shifts the focus from York Region to Newmarket.

I don't blame Vegh for dissembling - that's what he does. It is in his DNA.

In Newmarket he goes with the flow, otherwise he would have to argue his point of view with Taylor and the other councillors. He rarely does this as it makes him feel uncomfortable. He is, by nature, timid.

But at York Region, where he has a low, almost invisible, profile, he can take the developers' line without attracting too much attention. This is his pay-back to the developers who support him with barrow loads of cash at election time.

Public Debate

I want to debate these issues with Tom Vegh on a public platform.

It is not "mudslinging" as he suggests. It's democracy at work.

He can run but he can't hide.

I need to know if he is taking developers money in this election - as he did in 2018.

Why won't he tell us?

This email address is being protected from spambots. You need JavaScript enabled to view it.

Updated on 4 September 2022 to include the self-funding limit for Vegh's campaign for regional councillor - $16,103.60.

- Details

- Written by Gordon Prentice

This is the response to my appeal against Ted McFadden's decision not to print my reasons for running. He asked me to re-write it to omit any reference to my opponent, Tom Vegh.

I refused.

Tom Vegh and his ethical lapses are the very reasons I am running.

Time to move on, I think.

1 September 2022

Hi Gordon

Thank you for your email.

Ted McFadden has provided you with the reasons why we would not publish your reason for running as stated. The candidate profile is your opportunity to talk about yourself, but you have chosen to talk about someone else. That’s not the purpose of the profile.

You said you are not prepared to alter what you have submitted. I can only reiterate what Ted and Lisa Queen have communicated to you: we cannot print your answer as provided.

Sincerely,

Lori Martin

Lori Martin (she/her) | Deputy Director of Content

Metroland | Durham, Kawartha Lakes, Muskoka, Northumberland, Ottawa Valley, Parry Sound, Peterborough, Simcoe County, York

This email address is being protected from spambots. You need JavaScript enabled to view it.

- Details

- Written by Gordon Prentice

Newmarket’s ERA newspaper – which is delivered weekly free of charge to every home in the Town – won’t tell its readers why I am running for election as Deputy Mayor and Regional Councillor.

Ted McFadden, the Managing Director of Metroland York Region, who is responsible for editorial policy, asked me to rewrite my reasons for running to remove any reference to my opponent, the incumbent Regional Councillor Tom Vegh. I refused and I am appealing his decision.

Drunken Sailor

I am running because I want to see honest and ethical behaviour in municipal government and that means challenging Tom Vegh who spent like a drunken sailor in the 2018 election. He then had to be bailed out by developers’ money after the election to clear the debt he had run up.

Newmarket Today reported in 2019 that more than half of Vegh’s campaign contributions came from within the development industry.

The law now bans corporate and union donations to candidates running for office but private individuals can contribute up to a maximum of $1,200 per candidate. Money poured in to Vegh’s campaign from individuals who are also big names in the development industry. They just swapped hats and sent the cheque to Vegh.

$30,000 debt

After he won the election Vegh was still carrying a huge $30,000 debt.

He told Newmarket Today:

“After the election I started receiving a lot of cheques and some of those I sent back for one reason or another, if I wasn’t comfortable accepting it. But there’s a few there that I said, “Yeah, OK”.

Which begs the question - which cheques did he refuse to cash and why?

Vegh trilled:

“I won the election without their (developers) help, without even talking to them or them approaching me. And then we started receiving the donations.”

Obligation

It must have occurred to Vegh that taking money in this way could be seen as placing him under an obligation to the development industry. Without their money his election would have been challenged.

Vegh said;

“You know, $1,200 or whatever someone is giving me, I don’t think that’s nearly enough to influence anyone in a corrupt way. Second, I’m not corrupt. Third, there’s an entire Newmarket council there, don’t overestimate my influence on council.”

I don’t.

Tom Vegh has questionable ethics. His voting record on major planning issues at York Region more often than not follows the development industry line. He has voted to press ahead on controversial planning proposals after rejecting the benefit of advice from the Region's professional planning staff.

Tom Vegh is the reason I am running.

This email address is being protected from spambots. You need JavaScript enabled to view it.

Click "Read more" to see the email exchanges.

Read more: Newmarket's ERA Newspaper won't tell its readers why I am running for election

- Details

- Written by Gordon Prentice

The chair of York Regional Council, Wayne Emmerson, tells me he will be seeking a third term in November for the job which paid over $232,379 in 2021 plus generous benefits.

"I will be running for Chair in November. I will be asking York Regional Council to support me."

The Chair is indirectly elected by the 20 Mayors and regional councillors drawn from York Region's nine constituent municipalities.

Voters have no say

The Wynne Government picked up Chris Ballard's Private Members Bill and put it into law, forcing Regions to elect their chairs by the voters at large. In 2018 Doug Ford reverted to the old method of indirect election - meaning people had no say in choosing the regional chair.

York Region has a population larger than five Canadian Provinces.

Newmarket-Aurora's newly elected MPP, Dawn Gallagher Murphy, has not expressed a view on whether she favours the election of the regional chair by the voters at large or by the 20 members of the regional council. (Click "read more" below)

Indefensible

Emmerson's vote carries the same weight as members who are directly elected by the voters.

This is indefensible.

In March 2016 I made the argument to a Committee in Queen's Park. The case for direct election is as compelling as ever.

If elected to York Regional Council I would press for the election of the chair by the voters at large.

This email address is being protected from spambots. You need JavaScript enabled to view it.

Read more: Ontario’s Deformed Democracy: York Region Chair Wayne Emmerson seeks a third term

Page 62 of 281