- Details

- Written by Gordon Prentice

Yesterday (30 December 2022) the UK’s National Archives released almost 600 Cabinet Office files from 2001 and 2002.

They paint a fascinating picture of the challenges facing the Blair Government (which was first elected in 1997) and how Britain’s Prime Minister developed his strategies for governing.

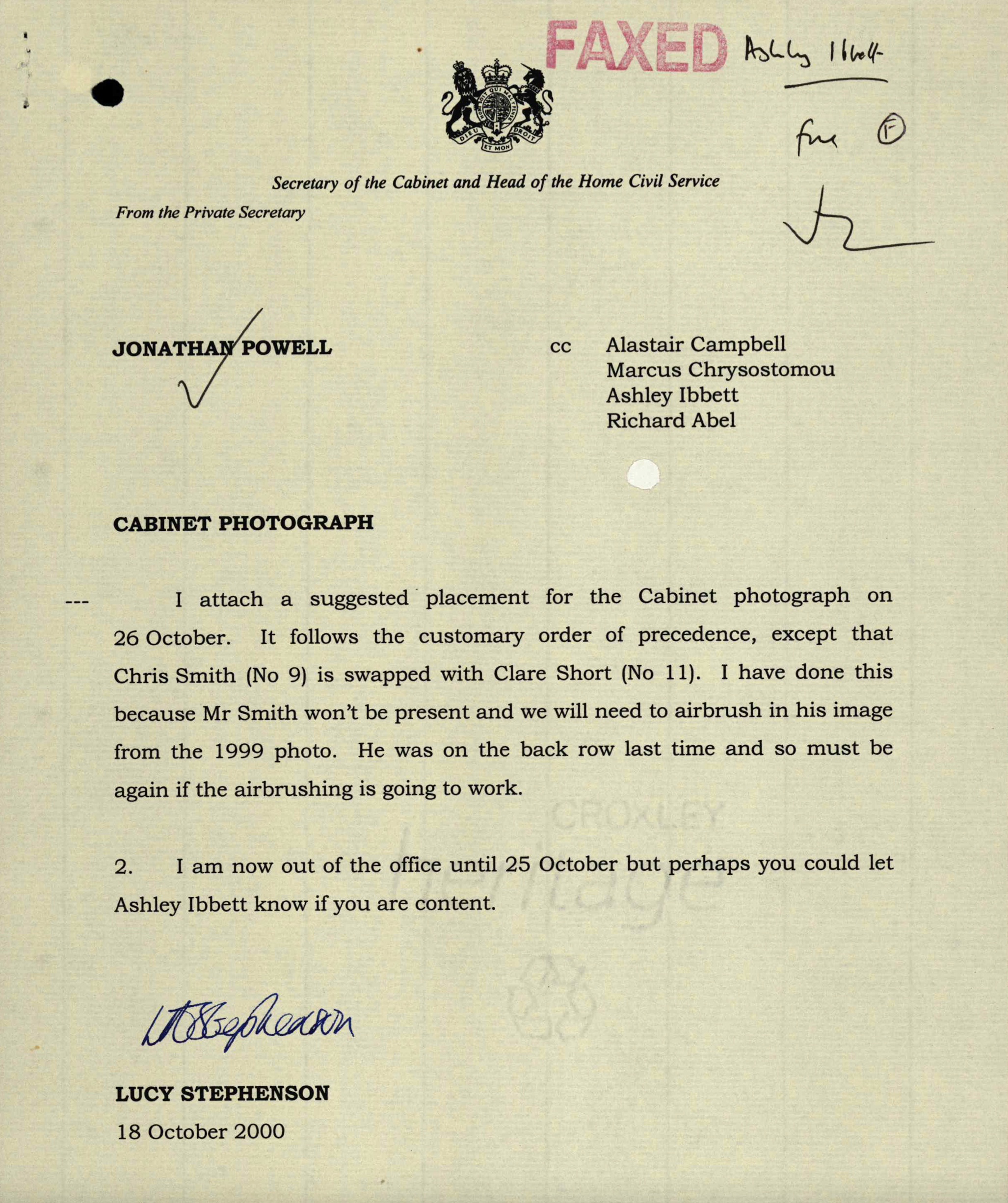

Fake News!

I discover the British Government was airbrushing people into Official Photographs – Soviet style. It leaves me wondering if people were ever airbrushed out. And all this before Donald Trump and his Fake News! (see right)

The National Archives say the papers – released under Freedom of Information legislation - give a snapshot of what was happening 20 years ago and at the turn of the century.

Unfortunately, the files are incomplete. Some information has been withheld – and the policy is not to explain why. So an email of 12 February 2001 concerning Conrad Black and his “possible peerage” is missing. At some point, hopefully, it will surface.

Tony Blair in Canada

The papers which document the preparations for Tony Blair’s first visit to Canada on 21-22 February 2001 as PM are absorbing. There are candid pen portraits of Prime Minister Jean Chrétien and the other major players in Canadian politics.

A note from the British High Commissioner in Ottawa, Sir Andrew Burns, on 1 February 2001 tells Blair that Chrétien will be in an "expansive mood" after his election victory in November 2000.

“He is sitting comfortably in Ottawa. His personal decision to call an early election was handsomely vindicated with an increased majority. The Opposition parties are in serious disarray. And he has seen off an early leadership review in his own party. For the moment he has no reason to fear the leadership ambitions of his popular and successful Finance Minister, Paul Martin. His own men hold the caucus leadership.”

Blair addressed the Canadian Parliament on 22 February 2001 and it is an education to see how the speech was put together - and what was included and left out.

Frozen Pensions

Officials offer Blair “lines to take” if the Canadians raise difficult issues such as “frozen pensions”. (At the time 140,000 UK pensioners living in Canada had their State pension frozen at the level which applied on the date they left the UK. But if they had moved to the United States, for example, their pensions would have been uprated annually as in Britain.)

UK State pensions are frozen in many countries with significant UK expatriate populations including Australia, New Zealand and South Africa.

It is clearly unfair.

Twenty years on, nothing has changed.

I doubt it ever will.

This email address is being protected from spambots. You need JavaScript enabled to view it.

Update on 10 January 2023: from the Guardian. Erasing Boris.

- Details

- Written by Gordon Prentice

Developers will not pay a cent towards the cost of providing roads, water and sewage and other key infrastructure needed to service new developments providing the housing is “affordable”. In York Region this would mean houses and apartments selling for $1,034,000 or less. Instead, the costs will be transferred from developers to local taxpayers.

Background: The More Homes Built Faster Act (Bill 23) – championed by Newmarket-Aurora’s new MPP, Dawn Gallagher Murphy – is deeply flawed legislation, rushed through Queen’s Park at breakneck speed with next to no consultation, leaving important details up in the air.

In a reward to their friends in the development industry, the Ford Government will no longer expect developers to pay Development Charges (DCs) on newly built housing which is deemed to be “affordable”.

What are Development Charges?

These DCs are fees paid by developers to municipalities to help pay for the capital costs of infrastructure needed to service new development. Without these DCs the costs of growth will fall on local residents rather than the developers.

York Region and lower tier municipalities such as Newmarket will take a huge financial hit as legislation will exempt thousands of newly built homes and apartments from DCs.

New Definition of Affordability

York Region’s Committee of the Whole last week considered a commentary from staff warning that Bill 23 introduces new definitions for housing affordability which is to be 80% of the average purchase price of a home.

“... Prior to Bill 23, using the Province’s definition of affordable home ownership, a York Region household that earns approximately $120,000 annually can only afford a home priced at $536,000.”

“In 2021, 80% of the average purchase price for homes sold in York Region ranged from $520,000 for a condominium to $1,282,000 for a single detached dwelling (or an average of $1,034,000 for all unit types). Having a threshold at 80% of the average purchase price for a home is too high to be considered an affordable ownership option for many residents in the Region and will now be subject to a full DC waiver.”

Unclear how average is to be calculated

The Regional Treasurer, Laura Mirabella, tells members the legislation does not define how the average will be calculated. She expects the definition to come next year. Will the average be calculated using sale prices by Region? Or, more narrowly, on a municipality by municipality basis? Or even on a Province-wide basis?

“It is completely unclear how “average” will be defined. But, yes, if the purchase price of affordable ownership housing new-builds is deemed to be 80% of whatever that average purchase price is, there would be a full exemption which would be a significant loss in development charge revenue for us.”

She says it is uncertain how many developers would take up the call to provide homes for sale at 80% of that average. (Click "Read More" below to read the exchanges)

Half a million dollar jump

The Region’s Chief Planner, Paul Freeman, adds:

“In 2021 80% of average home prices sold in York region range from a $520,000 for a condominium to $1.28M for a single detached. So the average is about just over $1,000,000 so anything under $1,000,000 is exempt from development charges…

“This is well above the provincial definition we've always used for affordable homeownership. For households that earns in our case, and it's based on the lowest earning 60% of households typically, it is $132,000 annually who can afford to buy a home which would be priced at about little over $500,000. So that's a half a million dollar jump for an exemption. And it is significant. It will add up to a lot of lost development charge revenue for municipalities.”

Half Baked

The More Homes Built Faster Act is half baked and the legislative process that produced it is broken. Queen's Park is a complete circus.

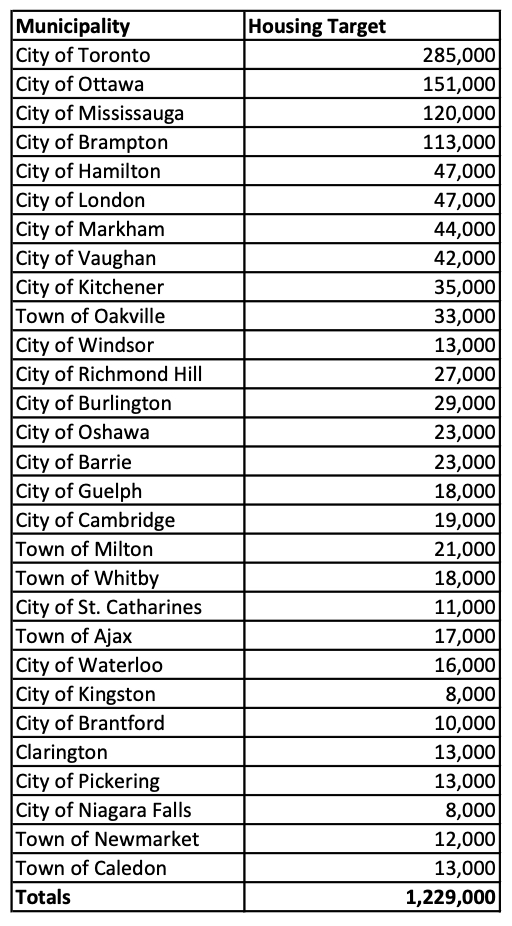

How is it that our MPP, Dawn Gallagher Murphy, can vote for legislation which mandates Newmarket to accept 12,000 new homes by 2031 when the Town's Mayor, John Taylor, is on the record saying that is an impossibility? (See table right)

How is it she will vote for a Bill which does such damage to housing services for the most vulnerable?

Bizarrely, Bills can receive Royal Assent before the end of the consultation period.

In a single chamber legislature such as ours - with no "sober second thought" back-stop - there is a special responsibility on MPPs to ensure the legislation they vote for is not incoherent rubbish.

This email address is being protected from spambots. You need JavaScript enabled to view it.

See also: What the Government is proposing and York Region's response. And here.

Update on 30 December 2022: From the Toronto Star: Need for services casts doubt on Province's plan

- Details

- Written by Gordon Prentice

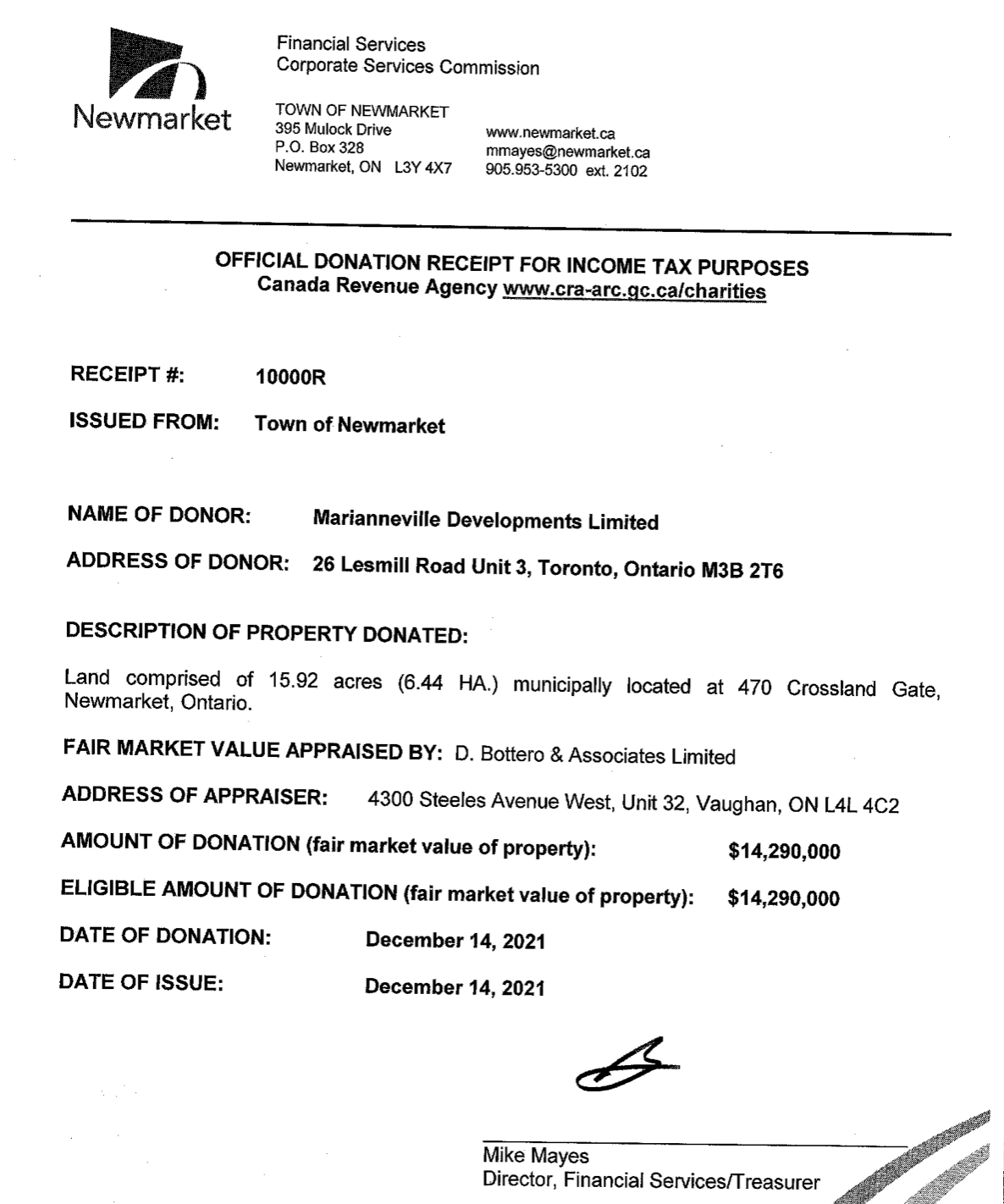

One year ago the Town of Newmarket gave the developer, Marianneville, a tax receipt for $14M in exchange for a donation of land at Glenway West.

To be clear, this $14M is not picked from the pockets of Newmarket taxpayers. It is, rather, a receipt purporting to reflect the value of the donated land which can then be used by the developer to offset tax otherwise owing to the Canada Revenue Agency.

I blogged about it here.

Work of Fiction

The $14M valuation report is a work of fiction based on “extraordinary assumptions” made by the valuer D Bottero & Associates. It assumes two large stormwater ponds can be drained and filled in to allow townhouses to be built on the donated land. I am unaware of any report by the Town’s planners or engineers saying this is feasible or practicable or would otherwise fit in with the Town’s policies.

When I asked the Town’s new Chief Administrative Officer, Ian McDougall, to commission a new valuation on the grounds the original one was flawed he told me on 14 April 2022 he would only do so if directed by the Canada Revenue Agency.

“The Town would not alter the amount on a Tax (or Donation) Receipt that has already been issued without direction from Canada Revenue Agency. Therefore, commissioning a new valuation report would have no practical purpose and would not be an appropriate expenditure of public funds. I will be asking staff to look into other municipalities' experiences in these sorts of donated land situations in order to positively evolve our approach from any best practices identified.”

Canada Revenue Agency

In the light of this I wrote to Toni Mancini, the Director General of the CRA’s Charities Directorate, on 22 April 2022 setting out the issues as I saw them. (For sight of this click “Read More” below).

After chasing them up a couple of times I was eventually told on 17 November 2022 that the CRA does

“not provide feedback or updates once a lead is submitted to us”

and that

“the Charities Directorate’s actions are only made public when they result in a charity being revoked, annulled, suspended or penalised.”

That’s fair enough. There are undoubtedly very good public policy reasons for keeping quiet about CRA investigations. But here we are not talking about the tax affairs of private individuals but rather the process for valuing land and whether the CRA’s own rules were followed. (The CRA stipulates the valuation and donation of land should happen more or less contemporaneously. Here, the so-called “fair market value” was assessed on 26 February 2021 and the tax receipt was issued on 14 December 2021 – an interval of 291 days.)

So, in the absence of any response from the CRA, I am going down the Freedom of Information route again to find out if this sort of thing is commonplace. I am careful not to name names.

Following the rules

I want to know how many times over the past five years the CRA has ordered a new valuation of land donated to a municipality on the grounds that the CRA’s own rules on such charitable donations were not followed.

And I am also curious to know how many municipalities have had their charitable status revoked, annulled or suspended or had suffered some other penalty – again, in each of the last five years.

If this kind of information is not routinely collected by the CRA I won’t get it - unless I am prepared to pay for a tailored search of the records.

And that could cost an arm and a leg.

So, what is the simple answer to this conundrum about estimating the true value of donated land?

I would run the valuer’s “extraordinary assumptions” past the planners and engineers and test them against the Town’s own policies which regulate development.

We may then get a valuation which passes muster.

And not the joke valuation which, for their own very different reasons, the Town and the developer are content to rely on.

This email address is being protected from spambots. You need JavaScript enabled to view it.

Below: Stormwater Pond 13 which the valuation report says can be filled in and the land used for townhouses. No other stormwater ponds in Glenway have been redeveloped in this way.

Note: I received the Bottero report following a Freedom of Information request to the Town of Newmarket. When I asked for it to be posted on the Town’s website I was told this would happen after the appraiser had provided the Town with an accessible PDF as required by the Accessibility for Ontarians with Disabilities Act. It has not yet been posted.

- Details

- Written by Gordon Prentice

Tomorrow (12 December) Newmarket Council will vote on a motion condemning Doug Ford’s Bill 23, More Homes Built Faster Act, 2022.

The motion says the Town cannot meet Ford’s stated target of 12,000 new homes by 2031. It says the Act will have a “significant negative impact” on heritage and social housing and will undermine environmental protection. It claims taxpayers across the province could be on the hook for up to $1 billion as developers’ costs are transferred to them.

Bill 23 is now law after being rushed through the legislature with many people wishing to comment but unable to do so because of the compressed timetable.

The Town’s motion will register its formal opposition to Bill 23 which, if passed, will go to the Municipal Affairs and Housing Minister, Steve Clark, and to our local MPP Dawn Gallagher-Murphy who is, unfortunately, a complete lightweight and cipher.

"Efficient local decision making"

Dawn Gallagher Murphy has been running ads in the local press expressing her support for Bill 23. And, last week, in her single contribution to the debate on its sister legislation, Bill 39, the Better Municipal Governance Act, she said this:

“The core of this legislation, it is very simple. I’ve read it over a few times now, and it is very simple. It gives local legislatures elected by Ontarians the extra tools that support efficient local decision-making. That’s something I want to reiterate: efficient local decision-making.

It also gives elected officials the tools they need to remove barriers that are stalling development, like housing. I want to reiterate that point: It’s stalling development.”

Majority Minority Rule

The Better Municipal Governance Act was also fast-tracked becoming law in three weeks from start to finish. It got a huge amount of media coverage, panning the proposal to allow the Mayor of Toronto to get his way if only one third of City councillors support his proposals which must be “Provincial priorities”. And, comically, it is the Mayor who decides if his proposals meet that test.

Gallagher Murphy talks about “local legislatures elected by Ontarians” blissfully unaware of the fact that the Bill gives the Municipal Affairs and Housing Minister the powers to appoint the Regional Chair in York region (and in Niagara and Peel).

Our MPP’s democratic credentials are, of course, wafer thin as she was personally selected by Doug Ford to run as PC candidate for Newmarket-Aurora with local Party members entirely cut out of the process.

As the official PC candidate she boycotted the election debates after claiming she missed the first one because of a “family emergency”. All invented.

Hypocrisy

In an excellent op-ed in this morning’s Toronto Star, Irene Ford draws attention to the hypocrisy of the Government’s approach (How far are Ontarians willing to go to protect the Greenbelt?). At the Provincial election only six months ago Ford was silent on his real agenda. A few bland slogans, echoed by Dawn Gallagher Murphy, concealed the true reality.

Returning lands to the Greenbelt

In her recent newsletter (2 December 2022) Gallagher Murphy says:

“Should these lands be removed from the Greenbelt, it is the government’s expectation that the landowners develop detailed plans to build housing quickly. Significant progress on approvals and implementation must be achieved by the end of 2023, with construction begun no later than 2025. If these conditions are not met, our government will return these properties to the Greenbelt.”

That's a hostage to fortune if ever I've heard one. And it will upset the powerful developers who bankroll the Progressive Conservatives.

Wastewater

This is a very accelerated timetable given that sewage and wastewater treatment capacity in Newmarket and the surrounding area is going to run out in five years. Gallagher Muphy can only deliver her promise if sewage and wastewater from the north of York Region can be directed in double-quick time down to Duffin Creek on the shores of Lake Ontario.

Personally, I'd like to see the Town invite Dawn Gallagher Murphy to a meeting to discuss the practicalities of delivering Doug Ford’s agenda – and the assault on our democracy.

I’d love to be a fly on the wall, listening to our Mayor and MPP in conversation.

It could be streamed or zoomed quite painlessly but, of course, it will never happen.

This email address is being protected from spambots. You need JavaScript enabled to view it.

Click “Read More” below to read Gallagher Murphy’s "Community Update and Greenbelt Message."

- Details

- Written by Gordon Prentice

Frank Klees is a consultant lobbyist and a former Progressive Conservative Cabinet Minister.

The Lobbyist Register shows that he has been involved in projects concerning the Greenbelt and in attempts to redraw its boundaries.

Fifteen years ago he told readers of the Auroran newspaper that he was proud to champion the Oak Ridges Moraine Protection Act and that the passage of this landmark legislation had taken the guesswork out of development applications in the moraine.

“Although we could not stop development that had been approved prior to the implementation of this act, more than 470,000 acres of land – much of it in York Region – are now permanently protected from development.”

Permanently protected?

Has he spoken recently to his close friend Doug Ford?

Building on the Greenbelt

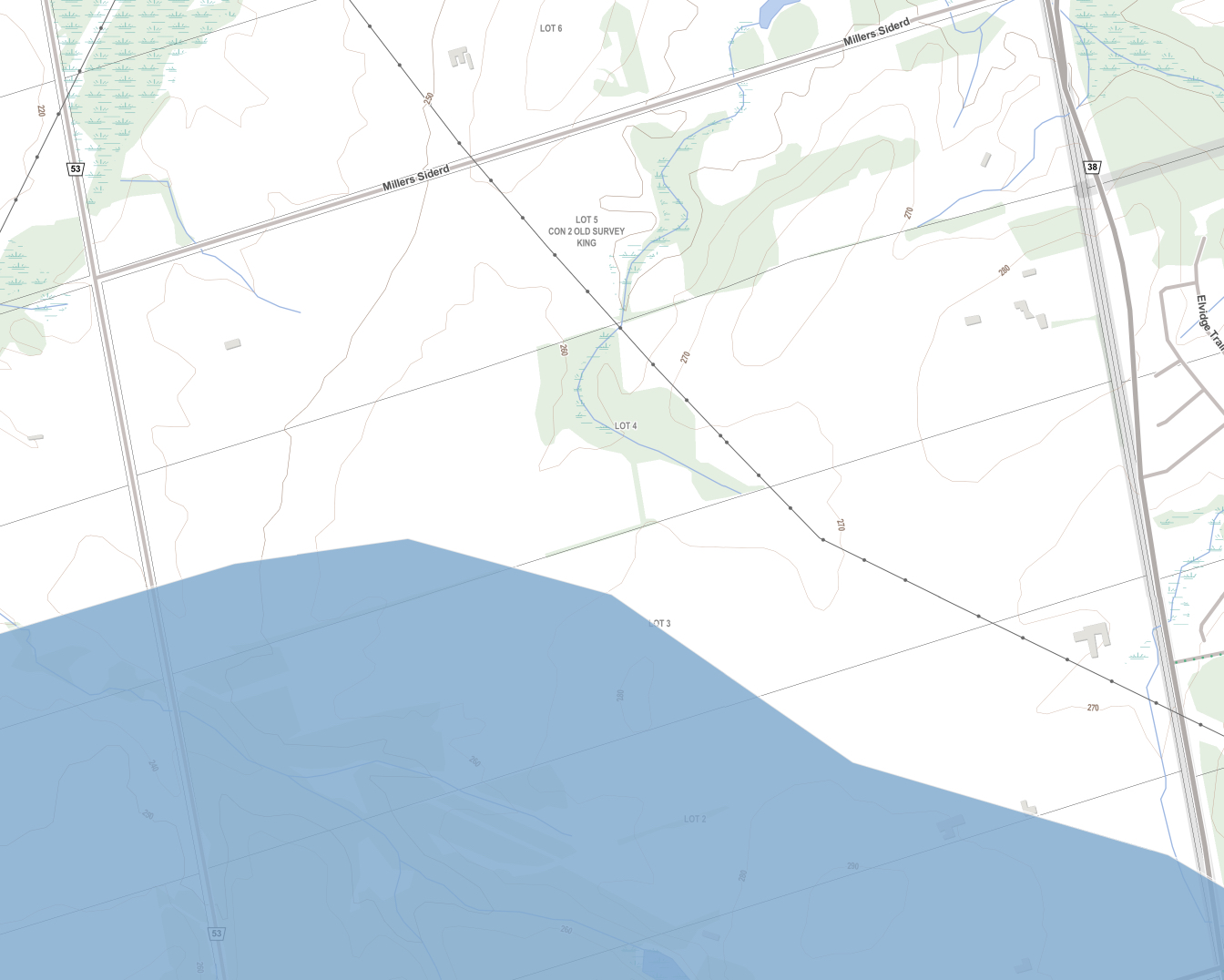

One of his past clients – the Rice Group – is now embroiled in a huge controversy over its recent $80M purchase of “permanently protected” Greenbelt land in the municipality of King, west of Bathurst and immediately adjacent to Newmarket. (Right: the Greenbelt land purchased by Rice, south of Miller's sideroad between Dufferin on the west and Bathurst on the east. The Oak Ridges Moraine is shown blue).

Klees lobbied for Michael Rice’s development group from October 2019 to September 2020 but we don’t know the details.

The land purchased by Rice is largely agricultural but with core area natural heritage features. The south-western portion lies within the Oak Ridges Moraine (see map).

Klees didn’t get back to the Toronto Star when they asked what he did for his client. But why not? The whole point of the Lobbyist’s Register is to make lobbying transparent.

What are you attempting to influence or accomplish?

Klees was asked to describe his lobbying goal(s) in detail.

“What are you attempting to influence or accomplish as a result of your communications with Ontario public office holders?”

He replied opaquely:

“The objective of the communications is to brief certain Ontario public office holders on the economic development opportunities represented by a number of the client's emerging projects.”

Is that kind of waffle from Klees even remotely acceptable?

The register tells lobbyists they should give specific information about their lobbying goals and the intended outcome of the lobbying.

Whatever happened to the specifics and the intended outcome?

Why doesn’t the Integrity Commissioner just ask him?

This email address is being protected from spambots. You need JavaScript enabled to view it. 6 December 2022

Click "Read More" for Frank Klees' letter to the Auroran 4 September 2007

See also: From the Toronto Star: Taking Durham Land out of the Greenbelt could cause irreversible damage says Parks Canada in blunt warning

Below: The Oak Ridges Moraine. "Permanently protected from development" according to Frank Klees in 2007.

Read more: The Consultant Lobbyist Frank Klees and the Greenbelt

Page 42 of 279